Little Known Questions About Copy Of Bankruptcy Discharge.

Bankruptcy Discharge Paperwork Fundamentals Explained

Table of ContentsA Biased View of How To Get Copy Of Chapter 13 Discharge PapersThe Buzz on How To Get Copy Of Chapter 13 Discharge PapersThe Basic Principles Of How Do I Get A Copy Of Bankruptcy Discharge Papers How To Get Copy Of Bankruptcy Discharge Papers - The Facts

/WhatYouNeedtoKnowAboutBankruptcy_fixed-cce9d8e9ff5f4141a9df65acb370858c.png)

For objectives of this magazine, references to U.S. trustees are also appropriate to insolvency managers. A fee is charged for converting, on request of the borrower, an instance under chapter 7 to an instance under chapter 11.

There is no fee for transforming from chapter 7 to phase 13. Unsafe financial debts usually might be defined as those for which the extension of credit report was based simply upon an evaluation by the creditor of the borrower's capacity to pay, as opposed to safe financial debts, for which the extension of credit report was based upon the financial institution's right to confiscate collateral on default, in addition to the borrower's capacity to pay.

The offers for monetary items you see on our platform originated from business that pay us. The cash we make helps us give you accessibility to cost-free credit rating as well as reports and assists us create our other excellent tools as well as academic products. Settlement may factor right into how and also where products appear on our platform (as well as in what order).

How Copy Of Bankruptcy Discharge can Save You Time, Stress, and Money.

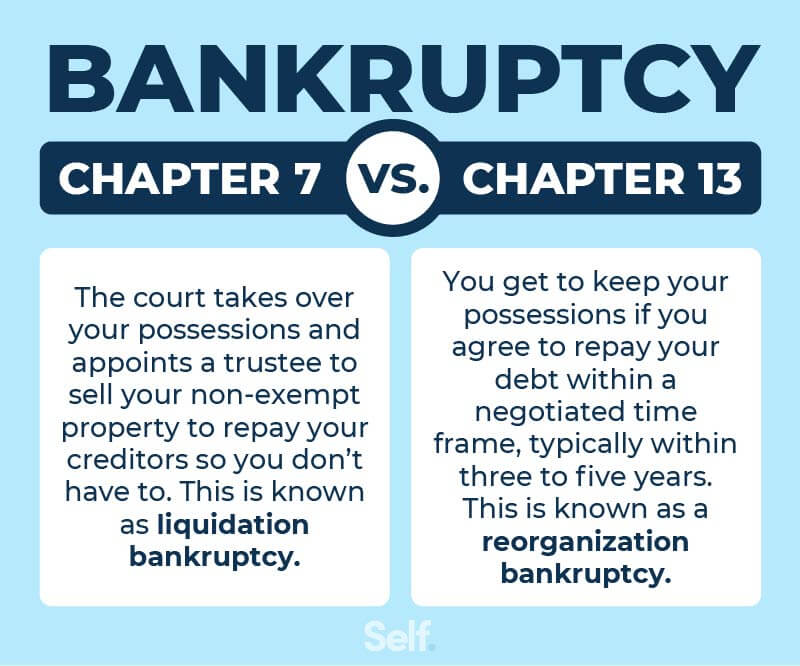

That's why we supply attributes like your Approval Probabilities and also savings estimates. Obviously, the deals on our platform don't represent all financial items around, however our objective is to show you as several excellent choices as we can. The primary step in determining whether a bankruptcy is right for you is specifying what it is.

Discharge is the lawful term significance you're not lawfully required to pay the financial obligation, and also collectors can not take any type of further action to accumulate it. Complying with an insolvency discharge, debt enthusiasts as well as lenders can no more attempt to gather the released debts. That suggests say goodbye to calls from collectors and no more letters in the mail, as you are no much longer personally responsible for the debt.

With a protected debt, the finance is connected to a property, or security, that lending institutions can confiscate if you stop paying. https://linktr.ee/b4nkruptcydc. Unsecured debt is not backed by collateral, so loan providers don't have the exact same option (copy of chapter 7 discharge papers). If you really feel the squashing weight of bank card financial obligation as well as a car loan on your shoulders, an insolvency could be a viable solution presuming you understand the consequences.

When you clean your financial slate with an insolvency, you'll have to take care of some credit-related consequences. A personal bankruptcy will stay on your credit scores reports for up to either seven or one decade from the date you file, depending on the sort of personal bankruptcy. Because your credit scores are calculated based upon the information in your credit history reports, a personal bankruptcy will certainly impact your credit history also.

Get This Report about How Do You Get A Copy Of Your Bankruptcy Discharge Papers

For more details, take a look at our short article on what takes place to your debt when you apply for personal bankruptcy. A released Phase 7 insolvency and also a discharged Phase 13 personal bankruptcy have the exact same influence on your credit report, though it's possible a loan provider might look more positively on one or the various other.

Removing financial obligation collection agencies is a great advantage, yet you may spend the better part of 10 years repairing your credit history. A bankruptcy discharge might be properly for you to get out of financial debt. Think about other courses to financial obligation flexibility and monetary security, such as a financial debt negotiation or a financial debt payment strategy, before choosing personal bankruptcy as the most effective means onward.

He has an MBA in financing from the University of Denver. When he's away from the key-board, Eric takes pleasure in checking out the globe, flying little Review more (http://ttlink.com/b4nkruptcydc)..

Noand several locate this truth unexpected. (a court-approved agreement to continue paying a financial institution).

How To Get Copy Of Chapter 13 Discharge Papers Can Be Fun For Everyone

Responsibilities emerging from fraud devoted by the borrower or accident triggered by the borrower while intoxicated are financial obligations that the court could state nondischargeable. A discharge relieves you of your responsibility to pay a debt, it won't get rid of a lien that a financial institution could have on your property.

Some liens can be gotten rid of, nonetheless, also after the closure of the insolvency case - copy of bankruptcy discharge. A regional personal bankruptcy lawyer will certainly have the ability to recommend you about your alternatives. Discover a lot more in What Happens to Liens in Phase 7 Personal bankruptcy? After the court issues the discharge, creditors holding nondischargeable debts can proceed collection efforts.

The info enables the lender to validate the bankruptcy and that the view released financial obligation is no more collectible. You'll find the declaring date and situation number on top of practically any record you receive from the court. The discharge date will certainly show up on the left-hand side of the discharge order instantly alongside the issuing court's name (you'll locate the case number in the top box).